With ever-increasing costs of living, inflation, economic recession, and slowing wage growth, the costs of owning and running a car in the UK have only risen since and are gradually becoming more and more difficult.

In fact, a recent 2024 survey and study done by NerdWallet UK estimates that around 65% of Britons aren’t actually aware of how much they’re paying to run and own a car. After all, the true cost of car ownership in the UK, which some experts refer to as ‘TCO’, or ‘total cost of ownership’ is much more complex than the average car owner in the UK actually realises.

Most of us, of course, are wary of fuel costs (or electricity bills, if you own an electric vehicle), the yearly MOT, as well as regular servicing and maintenance. Then, there’s your road tax, insurance, new tyres, and extra warranty cover on top of all that. These are some of the more basic elements to consider when calculating the true cost of car ownership in the UK.

But, these barely encompass the actual, total, true cost of owning a car. How about depreciation? That’s something few car owners in the UK keep track of, or even know of a way to calculate. Cars lose their market value the instant they’re driven away from the showroom.

Most cars in the UK lose up to 50% of their market value within the first three years of ownership. Even a very well-maintained car, with low mileage, and a somewhat sought-after vehicle, still loses between 15% to 35% of its market value in the first year of ownership.

Then, there are those cars, luxury, high-end, and performance cars, which could lose upward of 70% of their value with less than three years into the ownership period. Ouch. Alas, most car owners in the UK don’t have the tools, time, or understanding of how to calculate all this or to keep track of depreciation.

The Many Costs Associated With Owning A Car In The UK

Besides depreciation and those other costs of owning and running a car in the UK, the true cost of ownership can run way deeper. Depending on how pedantic or particular you are with keeping track of your expenses, the total cost of car ownership could go far beyond. Some of the other costs you ought to consider keeping track of might include (but aren’t limited to):

- Parking fees, which can be especially pricey if you live in London or larger cities.

- Tolls or permits, which ought to add up the more you drive or travel.

- Garage or driveway rental, assuming you have to rent or renovate a garage space to safely store your vehicle.

- Car wash or detailing, or the cost of individual car wash materials (sponges, shampoo, etc.), if you’re doing it DIY.

- Subscription to motoring organisations or owners’ clubs (i.e. the AA or RAC, or specific auto clubs you’ve joined).

- Fines or speeding tickets; not really applicable if you’re lucky, attentive, or are a safe driver by nature.

- Installation of a wall charger at home; only applicable if you own an EV and want to charge it at home.

Doing some research online and using my experience to back it up, the average cost of car ownership in the UK, as of 2024, is £3,400 per year. There is various publications online that support this figure and I believe it is a safe average to base our thinking on.

They note that, as per their analysis based on data from the Office for National Statistics, the costs of car ownership in the UK, as of 2024, is 19% higher than in 2020, just prior to the COVID-19 pandemic. A rise of £600 in just four years is no doubt alarming.

Can An Aftermarket Warranty Save You On Ownership Costs?

With all this in mind, there’s another major factor that we’ve yet to mention, and isn’t really easy to estimate or even predict… Sudden repair costs. We may never know when the cooling system might fail or if certain engine parts have gone awry, and if the transmission goes out on you. The best resource to gauge this is Warrantywise and its annual reliability index.

And hey, if you want to get the full, in-depth breakdown, check out my review, thoughts, and coverage of it here. Recently, Warrantywise, one of the leading aftermarket automotive warranty providers in the UK, released their 2024 report, ranking the top-most reliable used cars in the UK, using data from 2020 to 2023.

In this 2024 report, Warrantywise ranks the 4th-generation Toyota Yaris as the most reliable and durable used car you could buy in the UK today. Despite that, based on three-year warranty claims data from 2020 to 2023, Warrantywise showcases that the average repair request data is a not-so-miniscule £604.50.

In addition, they also reported that the highest repair requests amount among Toyota Yaris owners that have a warranty plan with Warrantywise, is a whopping £2,887.20. Among the rest of the top-10 in this list, in fact, most of the cars here range anywhere between £2,000 to £3,000 when it comes to their respective highest repair requests, for varying underlying faults and issues.

This goes to show that unexpected repair bills and sudden breakdowns can be quite costly. Warrantywise also notes in this 2024 report that within the three-year data collection period, that’s between January 1st of 2020 and September 30th of 2023, sees a worryingly significant increase in the cost of spare parts and labour hours.

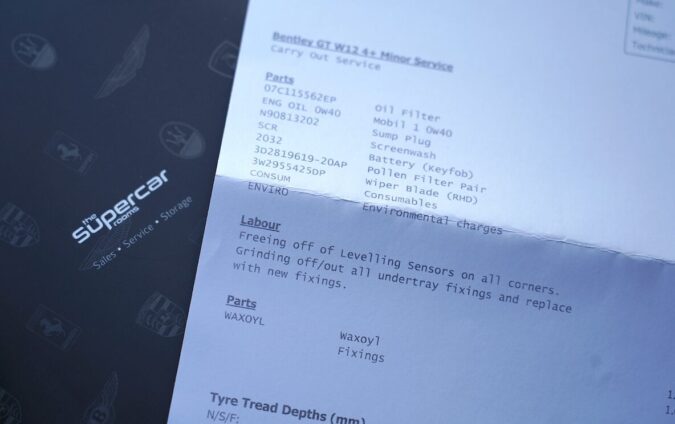

This should, ultimately, impact future repair costs. One way to limit your personal finances to the risk of these unexpected, oft-costly car repairs is to get an aftermarket automotive warranty. This is exactly what I did after I got my hands on a 2016 Bentley Continental GT Speed.

How Much Could An Aftermarket Warranty Really Save You?

One of the most appealing upsides to getting an aftermarket warranty for your car is being able to minimise and limit your financial downside to however much you’re paying in monthly or yearly premiums. As I detailed in my overview and thoughts on getting an extended aftermarket warranty from Warrantywise for the Continental GT, the monthly premium costs around £174, which is on the higher side of course down to the choice of car.

Yet, the single repair limit for that same warranty plan is £5,000. And, if you’re extremely unfortunate, you may encounter a handful of expensive issues like this over the course of your warranty cover period. Subject to the problem, the underlying cause itself, and your warranty’s terms and conditions, the warranty may help you cover the cost of the repair. That alone offers immense peace of mind when you’re buying a car, particularly one that’s well-used.

Therefore, if the clutch goes out due to a sudden failure and I need to get it replaced, rather than needing to cough up about £3,000 or so out of pocket, Warrantywise could cover those replacement costs, including parts and labour. Thus, my financial downside and risk are only limited to those monthly premiums. Again, remember that no warranty would cover a worn-out clutch or a clutch pack that’s nearing the end of its natural lifespan. But, a warranty plan – like Warrantywise – could help you out if it’s gone awry due to a sudden, unforeseen failure.

Speaking of, based on quotes by other Bentley Continental GT owners, the cost of unexpected, sudden repairs is not cheap. From what I’ve been able to research, here are some sample repair costs for a 2016 Bentley Continental GT, which on average, tallies to:

- New head gasket – £3,000+

- Transmission rebuild – £5,000+

- New transmission – £11,000+

- Sticky valves – £10,000+ (this is a common fault on older Bentleys, too)

- Power steering failure – £4,000+

- Replacement AC compressor – £5,000+

- Brand-new W12 engine – £26,000+

Even relatively minor issues, such as radiator repairs or power window motor replacements, from what I’ve been able to find, still cost roughly £1,000+ to do. Granted, I get that using a Bentley as an example might not be the best representative of the mainstream, general car market in the UK, it is just my current car to use as a reference.

But, as we’ve seen earlier with Warrantywise’s annual reliability index, even robust models like the Toyota Yaris can, if things go very wrong, cost you at least a couple of thousand pounds to fix. This is made worse given that these are unexpected problems, so most car owners aren’t often prepared to have all that cash on hand for a sudden repair job or breakdown, either.

For me, the choice was an easy one to make… Pay the monthly premiums to Warrantywise for providing a pretty comprehensive warranty cover for the Continental GT, and in return, I’m able to file and request a repair claim (if applicable, of course) that could pay off completely, or at the very least, most of a multi-thousand-pound visit to the workshop.

Even when we extrapolate this over the long term, and the costs of those monthly premiums start to stack up when considering the number of things that could go wrong, I’d likely be spending way more had I not have an aftermarket, extended warranty.

More Than Just Spare Parts And Labour Costs

And hey, don’t just take my word for it, Warrantywise has a live tracker and table for repairs paid, and here’s how much they’ve paid out for repairs on Bentley Continental GTs in their database that cover others besides myself:

- Shock absorber – £6,150

- Catalytic converter – £4,201

- Engine faults – £2,556

- Fuel system issues – £2,330

- Infotainment system – £2,022

- Heater matrix problems – £1,943

- Electrical faults – £1,139

On top of all this, Warrantywise doesn’t just provide cover for the repair costs (parts and labour) alone. The plan that I got from them includes emergency roadside breakdown recovery, arranging a replacement vehicle hire, as well as travel and overnight stay expenses, if I’m too far away from home and can’t drive back.

All in all, while an aftermarket extended warranty, like the ones Warrantywise offers, is another costly expense to account for the true cost of your car ownership, over the long run, should unexpected repairs and sudden problems come about, they could offset the cost of workshop visits by a significant amount. That attitude of “surely, nothing could ever possibly go wrong with my car” will only make things costlier and more complicated.